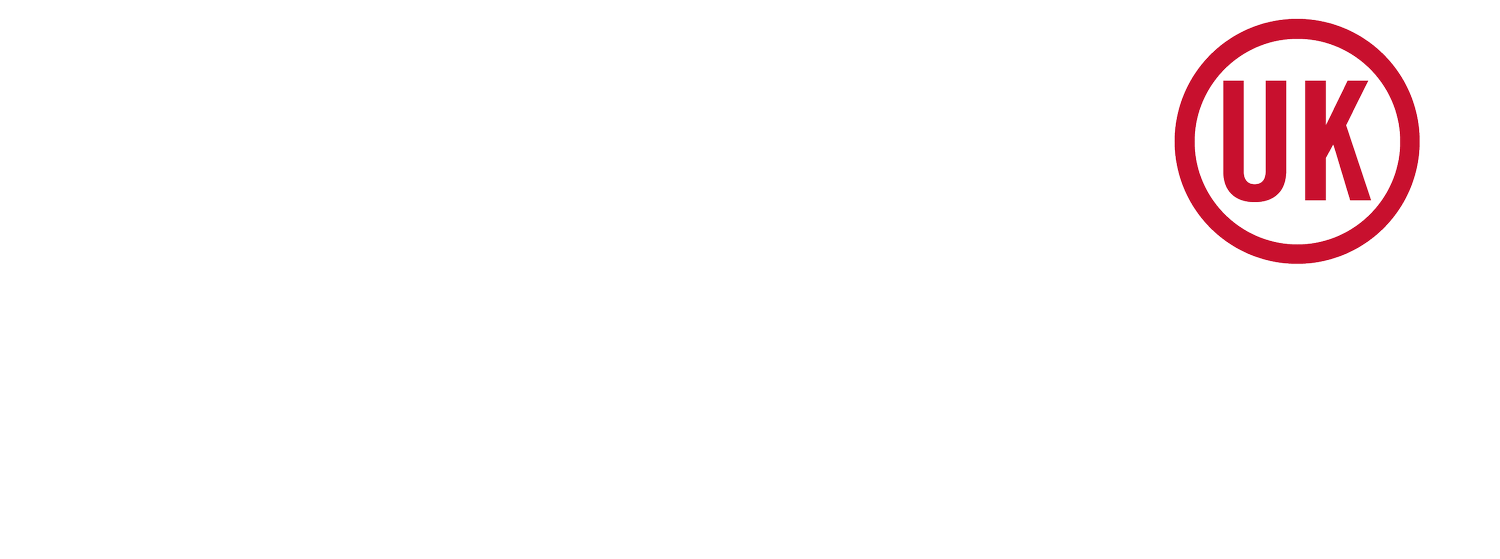

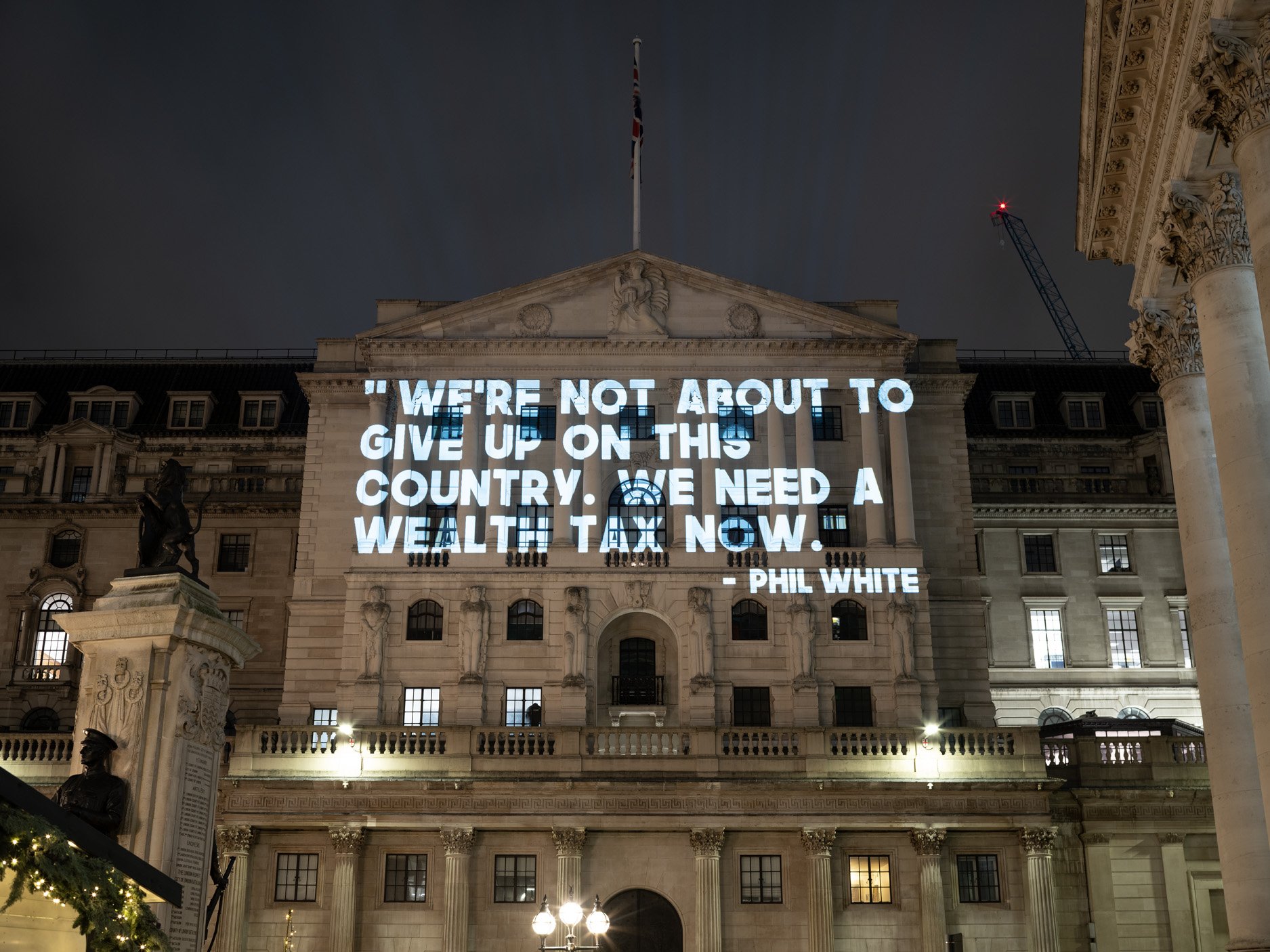

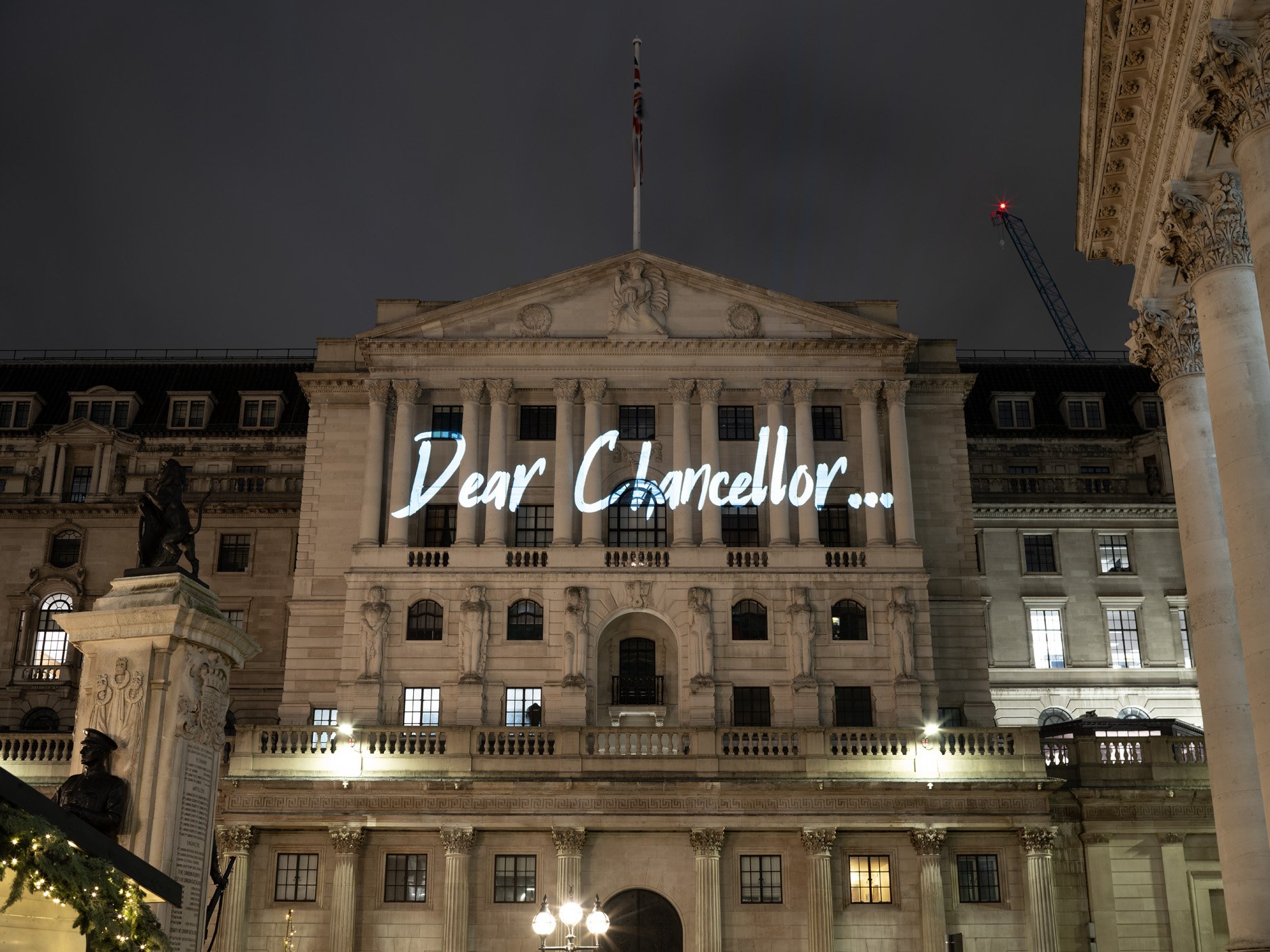

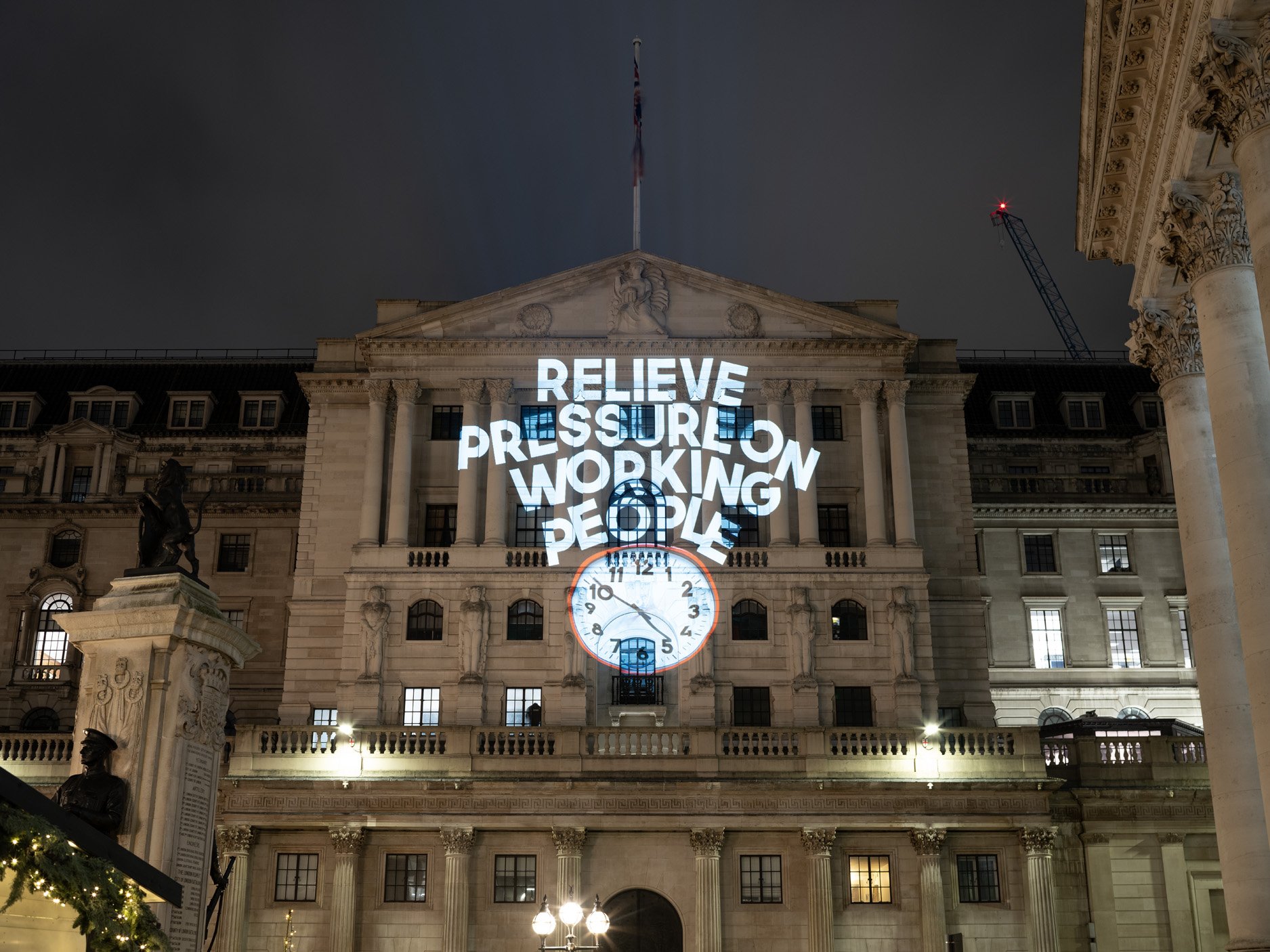

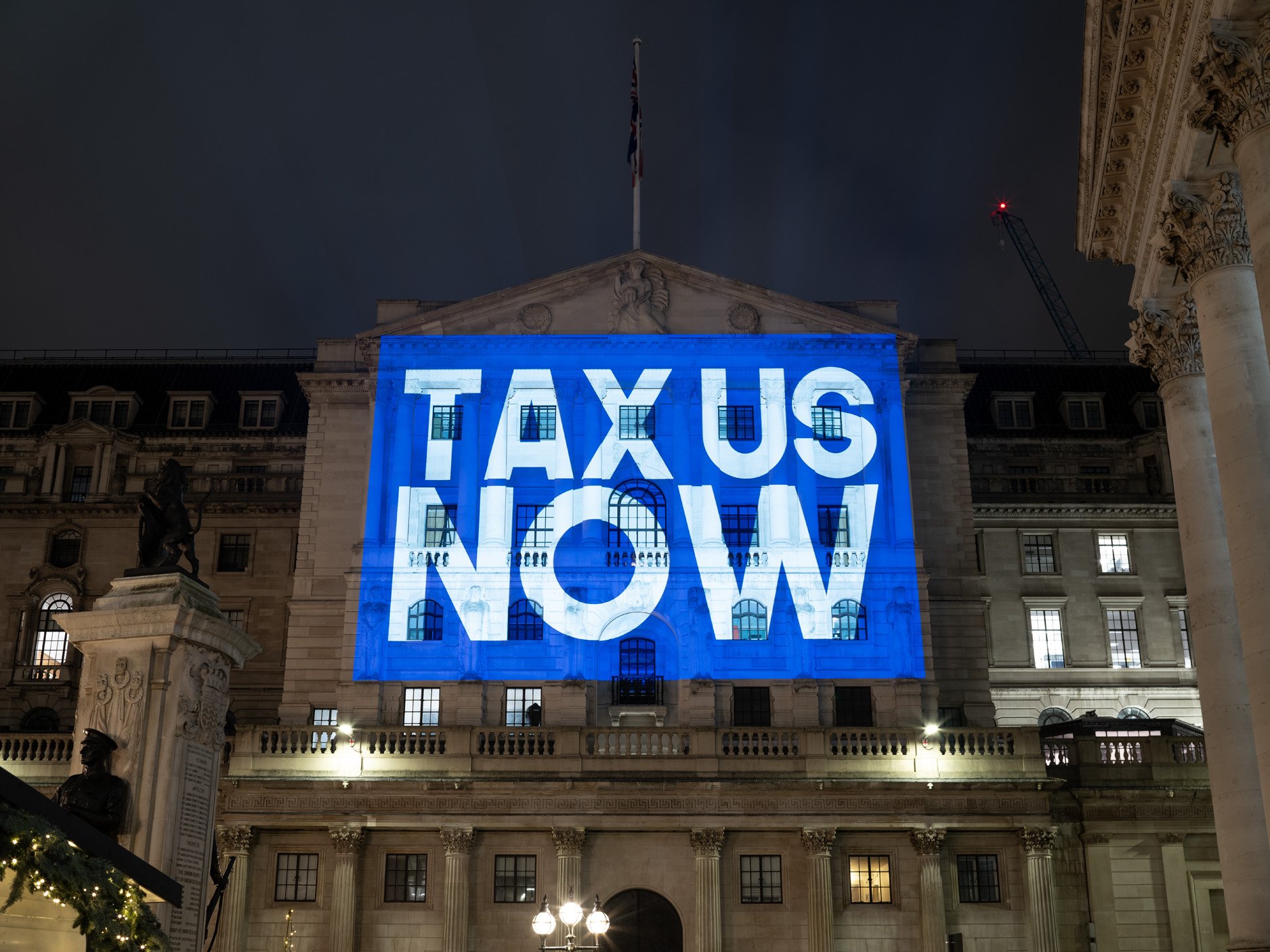

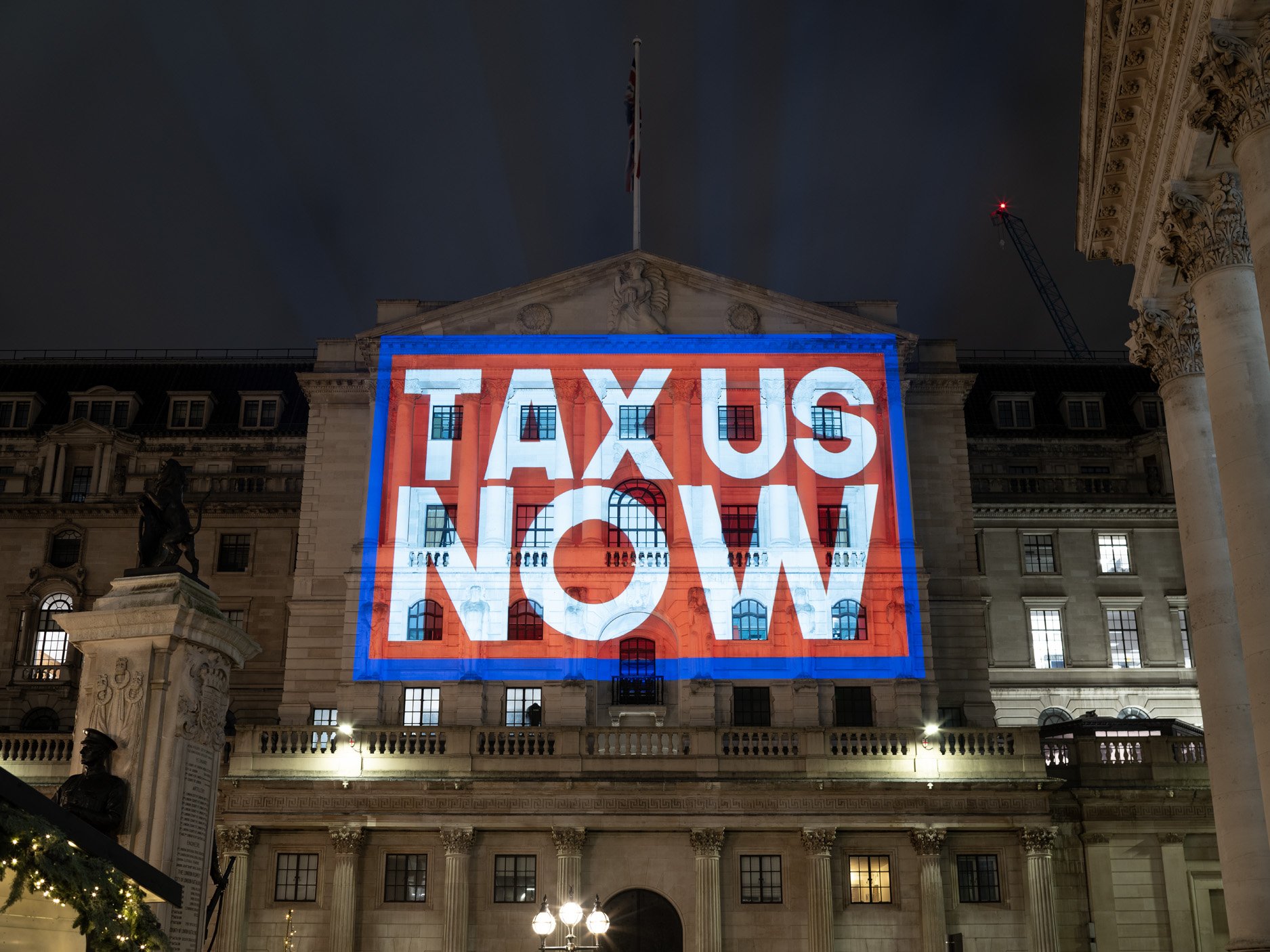

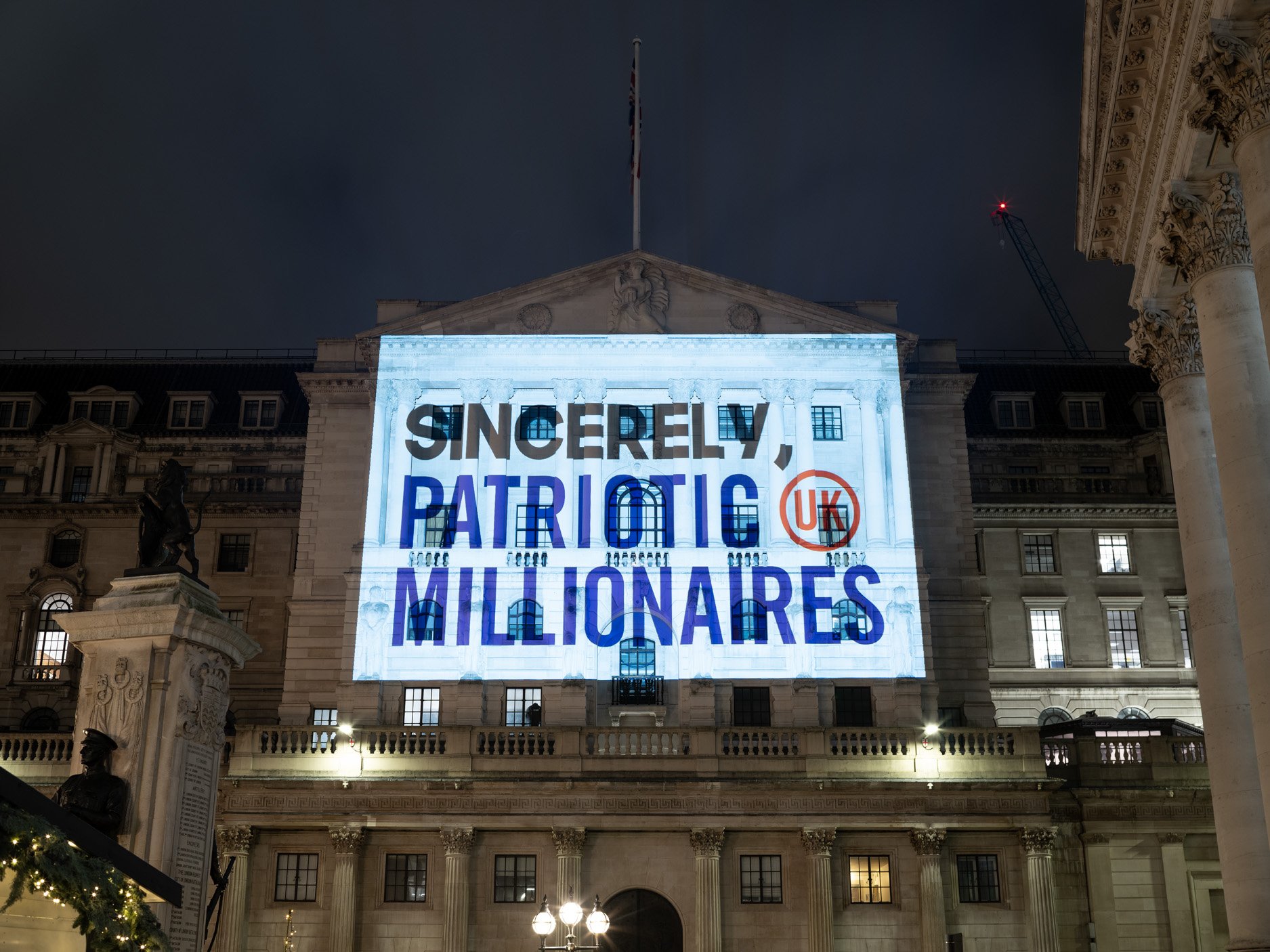

On the eve of the Autumn Statement, Patriotic Millionaires UK project a clear message to the Chancellor: tax our wealth and invest in Britain.

copyright anon

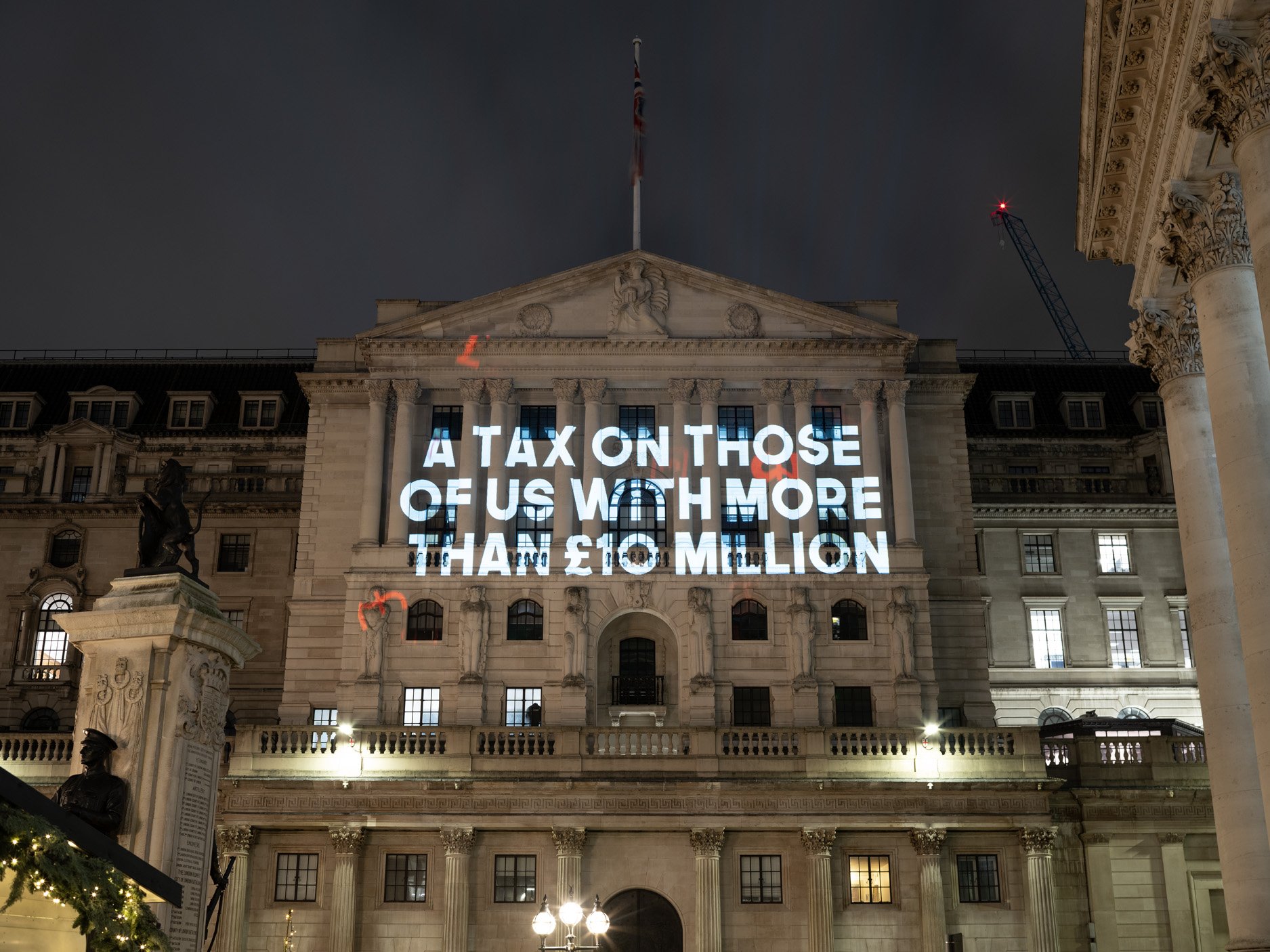

Messages projected onto the Treasury and the Bank of England highlighted the fact that a 2% tax on those with more than £10 million could raise £22 billion a year, or £423 million a week. That could pay for the average salary cost of more than 600,000 nurses a year - over three quarters of the UK’s nursing workforce.

This huge revenue raising potential comes as the Chancellor is rumoured to be considering alternatives that would either reduce the revenue available for national priorities or benefit the wealthiest 4 percent through cutting inheritance tax.

Patriotic Millionaires UK, an organisation of millionaires who want to see greater investment in Britain, are instead calling for tax rises on the super rich and have projected these messages onto the Treasury to remind the Chancellor of the wide support for this policy with both the public and the richest people in the UK.

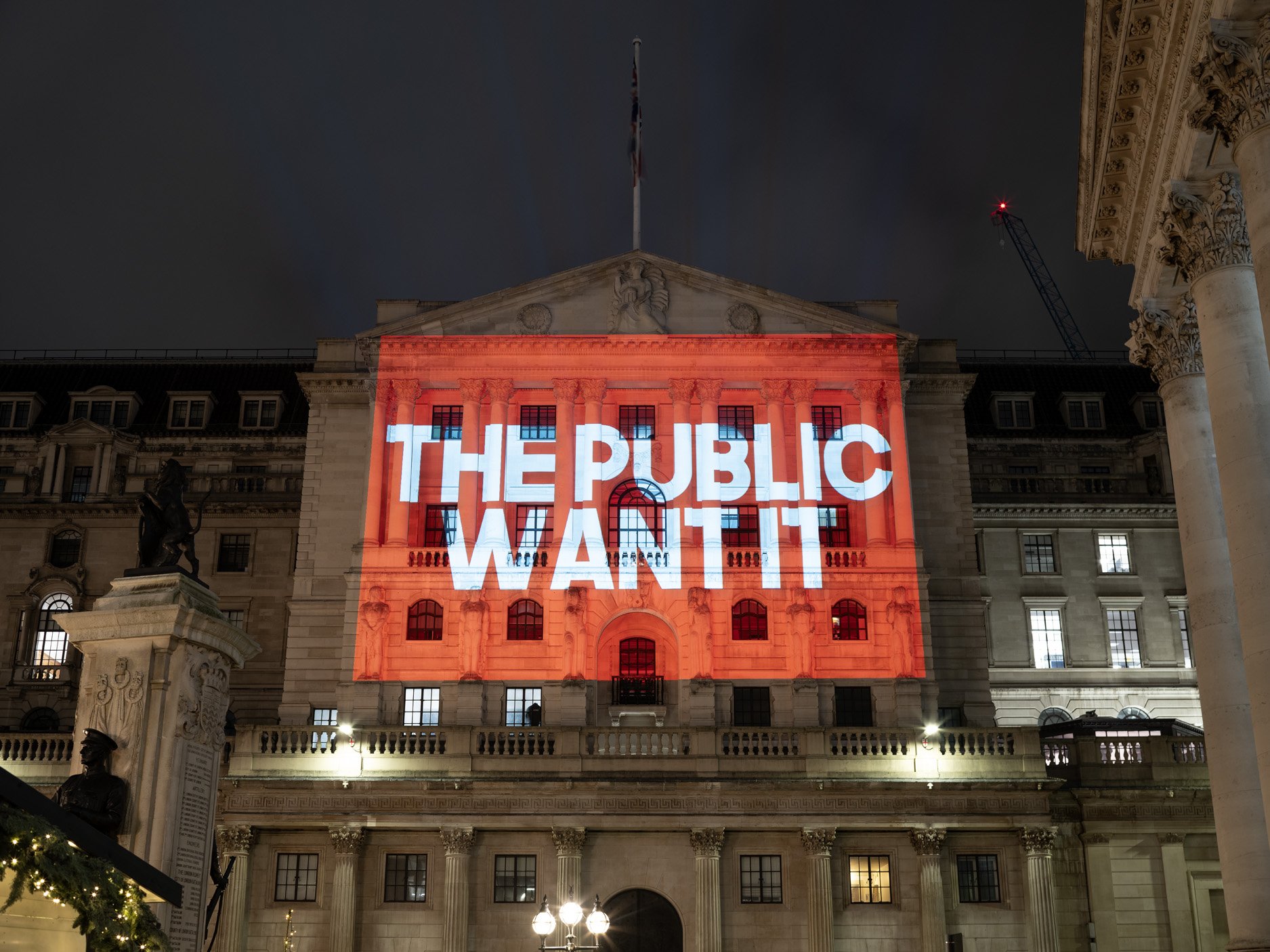

A YouGov poll found that three quarters of Brits support a wealth tax. While, earlier this year on behalf of PMUK, Survation polled those with investable assets of £1 million or more on their attitudes towards the economy, extreme wealth, and tax policy. This represents the top 6 percent of the UK population. The poll found -

68% of the richest 6% of the UK population polled support the introduction of a 2 percent tax on those with more than £10 million.

Across the political spectrum, a majority of voters polled from all political parties supported the introduction of such a tax, with the lowest level of support from Conservative voters at 51%.

A subsection of those polled included individuals with more than £10 million in assets - and an astounding 66 percent of this group supported the introduction of a wealth tax on themselves.

Furthermore, polling released by Tax Justice, undertaken by Opinium Research shows three in five Brits think closing tax loopholes should be a priority - rising to nearly three in four of those that voted Conservative at the 2019 general election. In addition, only 1 in 4 think that cutting taxes, rather than spending on public services, should be a priority for the Chancellor

Amid rumours of the Chancellor’s tax cutting agenda in the Autumn Statement, Phil White of Patriotic Millionaires UK said: “The whole country knows that we need a serious injection of capital to get us back on track. We have a potential £423 million a week, which is currently absent from national investment revenue, because we don’t tax extreme wealth. Surely the people in the UK deserve more? For a better Britain our Government should prioritise taxing those of us who can most afford it”

Responding to the idea that cutting taxes on inheritance could appear in the Autumn Statement Mr White added: “To prioritise cutting taxes, especially for the very richest, is dismal decision-making from this Chancellor on tax reform. Instead we can increase investment in Britain and take the pressure off working people by taxing the super rich.”

Rachael Henry of Tax Justice UK said: 'Taxing those with extreme wealth and closing the loopholes that allow them to further reduce their taxes is long overdue. Our analysis at Tax Justice UK shows that closing just five unfair tax loopholes, that benefit wealthy individuals and multinational companies, could raise over £7 billion a year for vital public services. And that’s even before introducing much needed policies such as a wealth tax”

Watch the video and share: